The FinClusive Risk Profiles are designed to provide you with a risk rating for each of your clients on the FinClusive platform. The risk profiles are comprised of three different ratings (low, medium, and high). The risk profiles consist of risk scoring based on the variables provided during the onboarding of your client. These ratings are adjustable to meet the requirements of your AML policy.

Each profile rating allows for different tests to be run against the profile, driven by the risk the client represents. Each of these tests are standard. Customized profiles are available to meet unique needs of customers.

| Profile A - Low Risk | Profile B - Medium Risk | Profile C - High Risk | |

CDD Elements (Individual) |

|

|

|

| CDD Elements (Entity) |

|

|

|

| Revalidation | Available | Available | Available |

| Ongoing Monitoring | Available | Available | Available |

| Liveness Check | Optional | Optional | Standard for individuals |

| Optional EDD Elements |

|

|

|

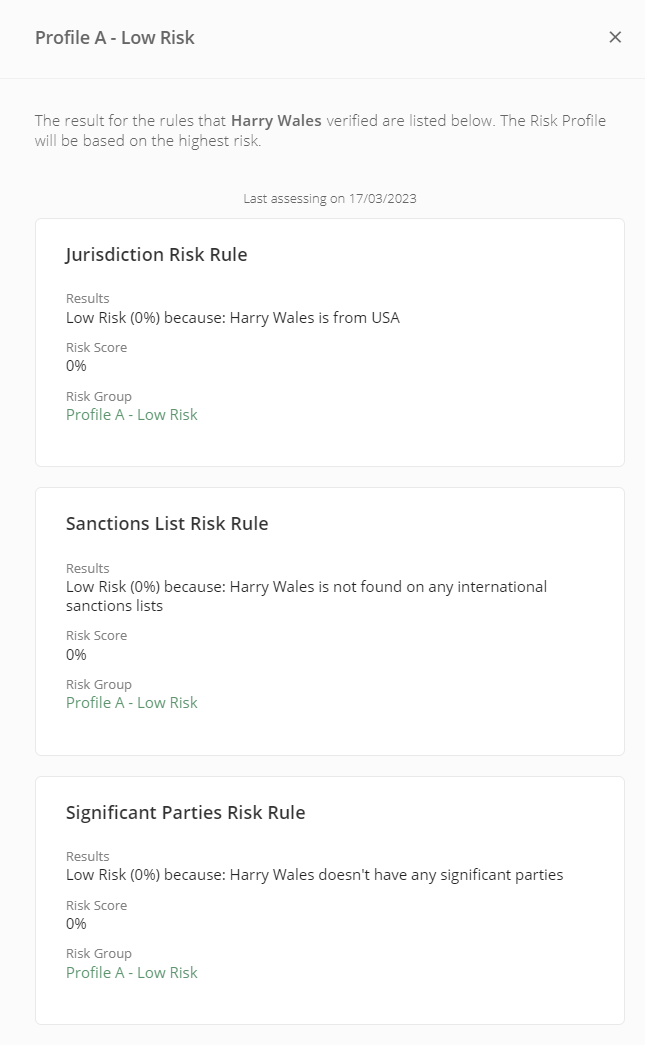

With each profile, you will be able to see what is driving the proposed rating by clicking the blue quote box. This risk rating is available both on the entity and significant parties, along with individual profiles.

How to update risk rating

- Click on the drop-down box next to the risk type.

- Select the new risk type, and then enter comments of why the risk is being changed.

- Select Done

If you are a FinClusive Gateway customer, you will not be able to select a lower risk then what is suggested. You will always have the option of selecting a higher risk, but never going lower.

Each time that reassess risk rating is clicked, a cost will be incurred. This is due to new and refresh checks being completed. For any tests that have doc validation or liveness checks included, your client will be asked to upload the required documents to make sure nothing has changed.